What Is The Tax Bracket For 2025 In Canada. For example, in the 2025 tax year, if you earn $80,000, you will be in the $55,867 to $111,733 federal tax bracket with a tax rate of 20.5%. Canada child benefit, child disability benefit.

The indexation increase has affected a credits, amounts, and benefits for those with children or other dependents. 2025 tax rates and brackets canada.

2025 tax brackets canada joye nellie, learn how the new tax bracket thresholds and indexed rates may impact your tax bill.

2025 Tax Rates And Brackets Canada Revenue Agency Dredi Lynnell, For instance, a taxable income of rs 10 lakh under the old regime has a tax liability of rs 1.17 lakh—an effective rate of 11.7%. Learn how the new tax bracket thresholds and indexed rates may impact your tax bill.

2025 Tax Brackets Canada Deva Silvie, The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5%. Calculate your tax bill and marginal tax rates for 2025.

Tax Brackets 2025 Canada Onida Nanice, Canada child benefit, child disability benefit. For example, in the 2025 tax year, if you earn $80,000, you will be in the $55,867 to $111,733 federal tax bracket with a tax rate of 20.5%.

2025 Tax Code Changes Everything You Need To Know, Calculate your combined federal and provincial tax bill in each province and territory. Discover key strategies like maximizing deductions, planning for future changes, and investing in rrsps/tfsas.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Get the latest rates from kpmg’s personal tax tables. Learn how the new tax bracket thresholds and indexed rates may impact your tax bill.

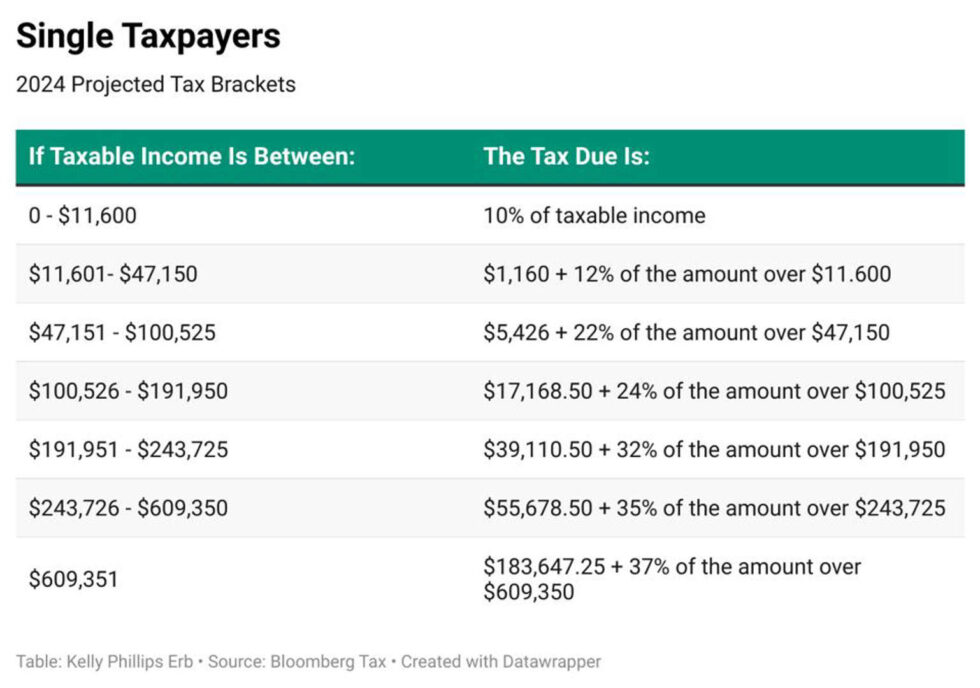

Federal individual tax rates and brackets for 2025 Akler Browning LLP, 2025 cwb amounts are based on 2025 amounts indexed for inflation. Tax brackets are used to calculate your federal income taxes.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, What are canada's federal 2025 tax brackets and rates? The government adjusts these brackets.

How Do Tax Brackets Work and How Can I Find My Taxable, The following are the federal tax rates for tax year 2025 according to the canada revenue agency (cra): The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not indexed for inflation.

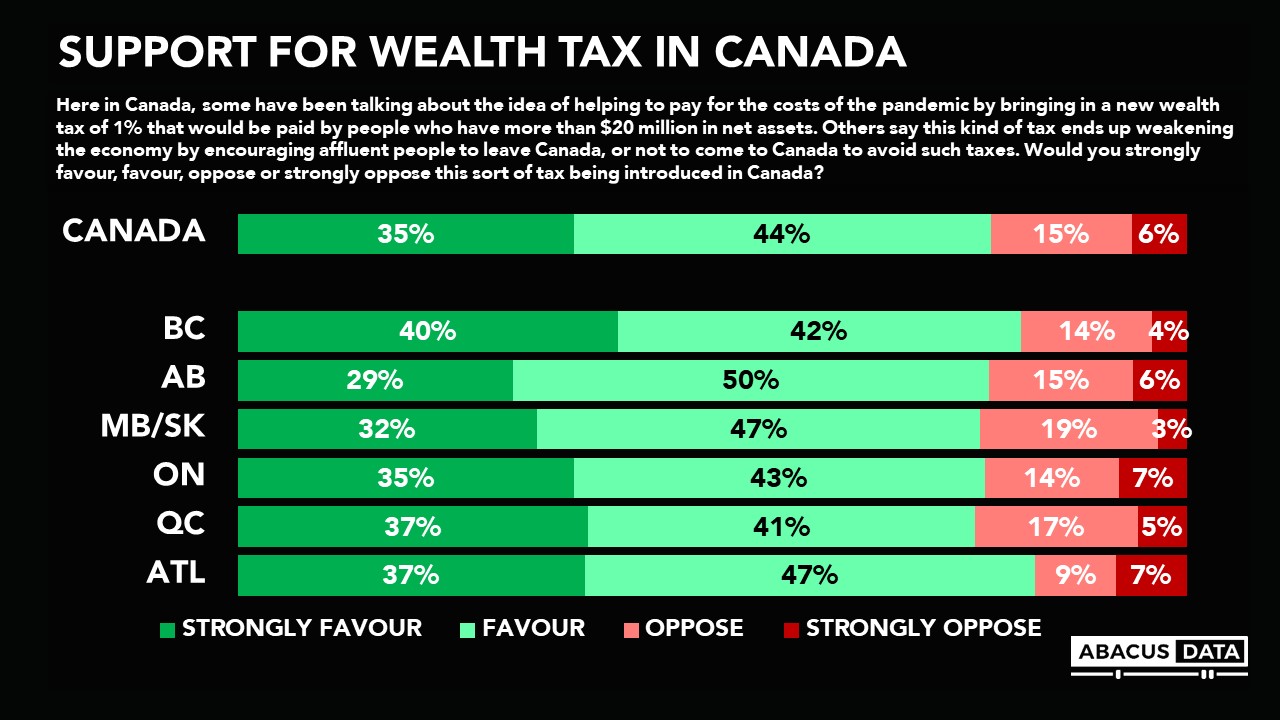

Canada Federal Tax Brackets 2025 Cele Cinderella, Budget 2025 just dropped, and it includes higher taxes for wealthy canadians, which will apply on or after june 25. The federal income tax rates and brackets for 2025 and 2025 are:

Federal Tax Brackets 2025 Canada Fern Orelie, 2025 federal tax bracket thresholds. 15% up to $55,867 of taxable income.