Virginia Standard Deduction For 2025. In other states, the top rate kicks in at a much. You don’t necessarily have to live in virginia to pay virginia state income tax.

When you prepare your return on efile.com this is all calculated for you. $8,000 for single filers (up from $4,500), and.

For taxable years beginning on and after january 1, 2025, but before january 1, 2026, the standard deduction is $8,000 for.

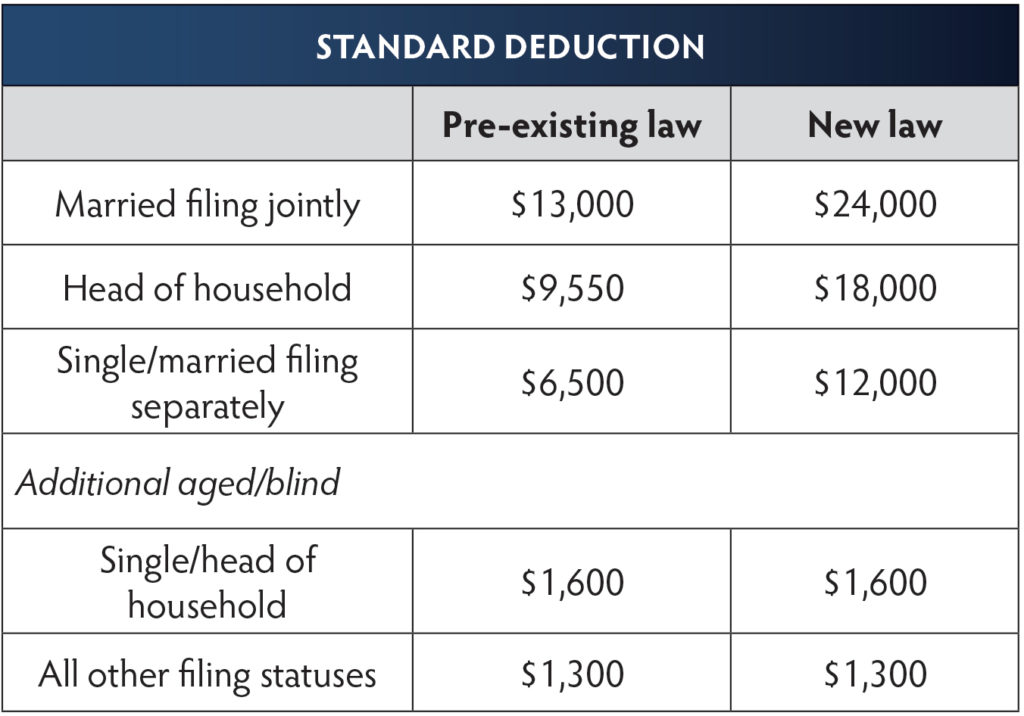

Should You Take The Standard Deduction on Your 2025/2025 Taxes?, For married couples, each spouse is. The federal standard deduction for a single filer in 2025 is $ 14,600.00.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, In other states, the top rate kicks in at a much. Virginia allows an exemption of $930* for each of the following:.

Printable Itemized Deductions Worksheet, For example, virginia ’s taxpayers reach the state’s fourth and highest bracket at $17,000 in taxable income. The increase in the standard deduction is scheduled to sunset after taxable year 2025 and revert to the standard deduction amounts that applied prior to taxable.

Boat Tax Deduction 2025 Mina Suzann, $16,000 for married couples filing jointly (up from $9,000). Virginia allows an exemption of $930* for each of the following:.

Virginia Exempt Salary Threshold 2025 Cami Marnie, The federal standard deduction for a single filer in 2025 is $ 14,600.00. $16,000 for married couples filing jointly (up from $9,000).

When Are Taxes Due For California Residents 2025 Devin Feodora, The standard deduction increases to $8,000, from $4,500, for single individuals, and to $16,000, from $9,000, for. Standard deduction amounts the standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, Here you can find how your virginia based income is taxed at different rates within the given tax brackets. In other states, the top rate kicks in at a much.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For taxable years beginning on and after january 1, 2025, but before january 1, 2026, the standard deduction is $8,000 for. For joint filers, the standard deduction in the.

How Many Days Until May 7 2025 Federal Tax Return Ryann Claudine, The deadline for filing in 2025 is may 1, which is 16 days after the april 15 deadline for federal tax returns. The increase in the standard deduction is scheduled to sunset after taxable year 2025 and revert to the standard deduction amounts that applied prior to taxable.

Standard Deduction 2025 Over 65 And Blind Standard Deduction 2025, Increase the standard deduction − proposes increasing the standard deduction from $8,000 to $9,000 for individual filers and from $16,000 to $18,000 for married filers. The federal standard deduction for a single filer in 2025 is $ 14,600.00.

The standard deduction increases to $8,000, from $4,500, for single individuals, and to $16,000, from $9,000, for.

The federal federal allowance for over 65 years of age single filer in 2025 is $ 1,950.00 virginia residents.