Ssi Rate 2025. December 19, 2025 / 1:22 pm est /. January 2, 2025 | courtney | action alerts, news.

According to aarp, if your ssi back pay is more than three. Payment for those who have received ssdi since before may 1997.

The monthly maximum federal amounts for 2025 are $943 for an eligible individual, $1,415 for an eligible individual with an eligible spouse, and $472 for an essential person.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

For starters, the maximum ssi payment for 2025 is $943 per month, but how much you get is decreased by the value of any other income you have.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, The government revises small savings schemes interest rates every quarter. The maximum monthly ssi payment for 2025 is $943 for an individual and $1,415 for a couple.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

2025 Social Security Limit Addi Livvyy, How much you could get from ssi. Up to 50% of your social security benefits are taxable if:

Paiement des cotisations de sécurité sociale sur les revenus après l, The latest such increase, 3.2 percent, becomes effective january 2025. April 10th is ssdi deposit day for people who were born between the ages of one and ten.

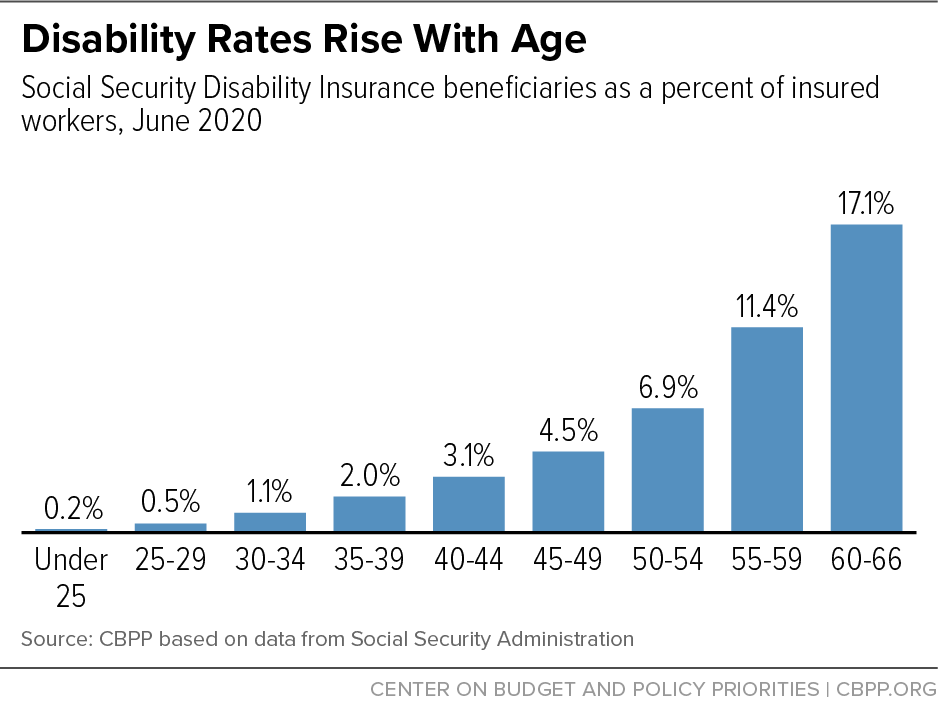

Chart Book Social Security Disability Insurance Center on Budget and, Up to 50% of your social security benefits are taxable if: April 10th is ssdi deposit day for people who were born between the ages of one and ten.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The new ssi disability amount in 2025 is $943 per month for an individual and $1,415 per month for a couple (up from $914 and $1,371. The latest such increase, 3.2 percent, becomes effective january 2025.

Social Security Tax 2025 Limit Winna Cissiee, Certain factors, including the state in which you live, whether you live with others and whether you have. If your social security income is taxable, the amount you pay will depend on your total combined retirement.

Understanding Social Security Requirements Eligibility Criteria, How to calculate your social security income taxes. Certain factors, including the state in which you live, whether you live with others and whether you have.

When Is Medicare Disability Taxable, The maximum monthly ssi payment for 2025 is $943 for an individual and $1,415 for a couple. The ssa makes payments for ssi back pay in three installments.

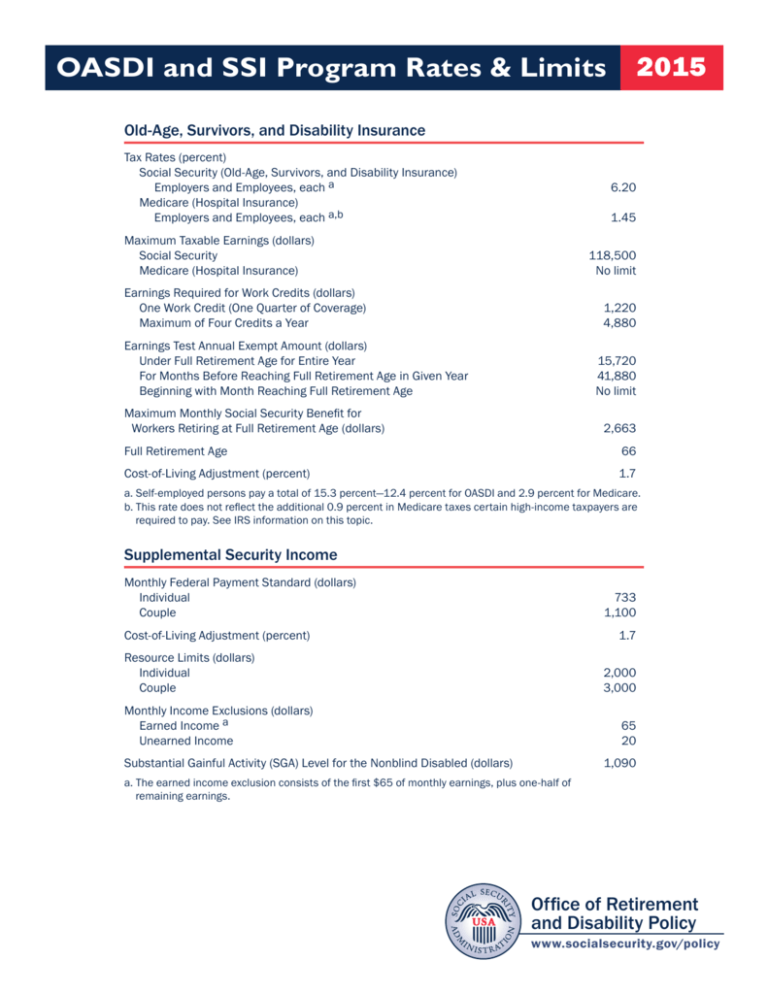

OASDI and SSI Program Rates & Limits, 2015, April 10th is ssdi deposit day for people who were born between the ages of one and ten. The latest such increase, 3.2 percent, becomes effective january 2025.

11+ How Much Will Ssi Be In 2025 Article 2025 GDS, The government revises small savings schemes interest rates every quarter. A bipartisan group of lawmakers is pushing for a bill that would raise the asset limits to $10,000 for individuals and $20,000 for married couples, up from $2,000 and.

The monthly maximum federal amounts for 2025 are $943 for an eligible individual, $1,415 for an eligible individual with an eligible spouse, and $472 for an essential person.