Keogh Plan Contribution Limits 2025. 401(k)s limit you to $22,500 in contributions in 2025 if you’re. Save for the retirement you want to have and maximize your contributions within the irs limits for 2025.

However, they’ve declined in popularity, with individual/single 401 (k)s and sep iras climbing to the top of the list of retirement.

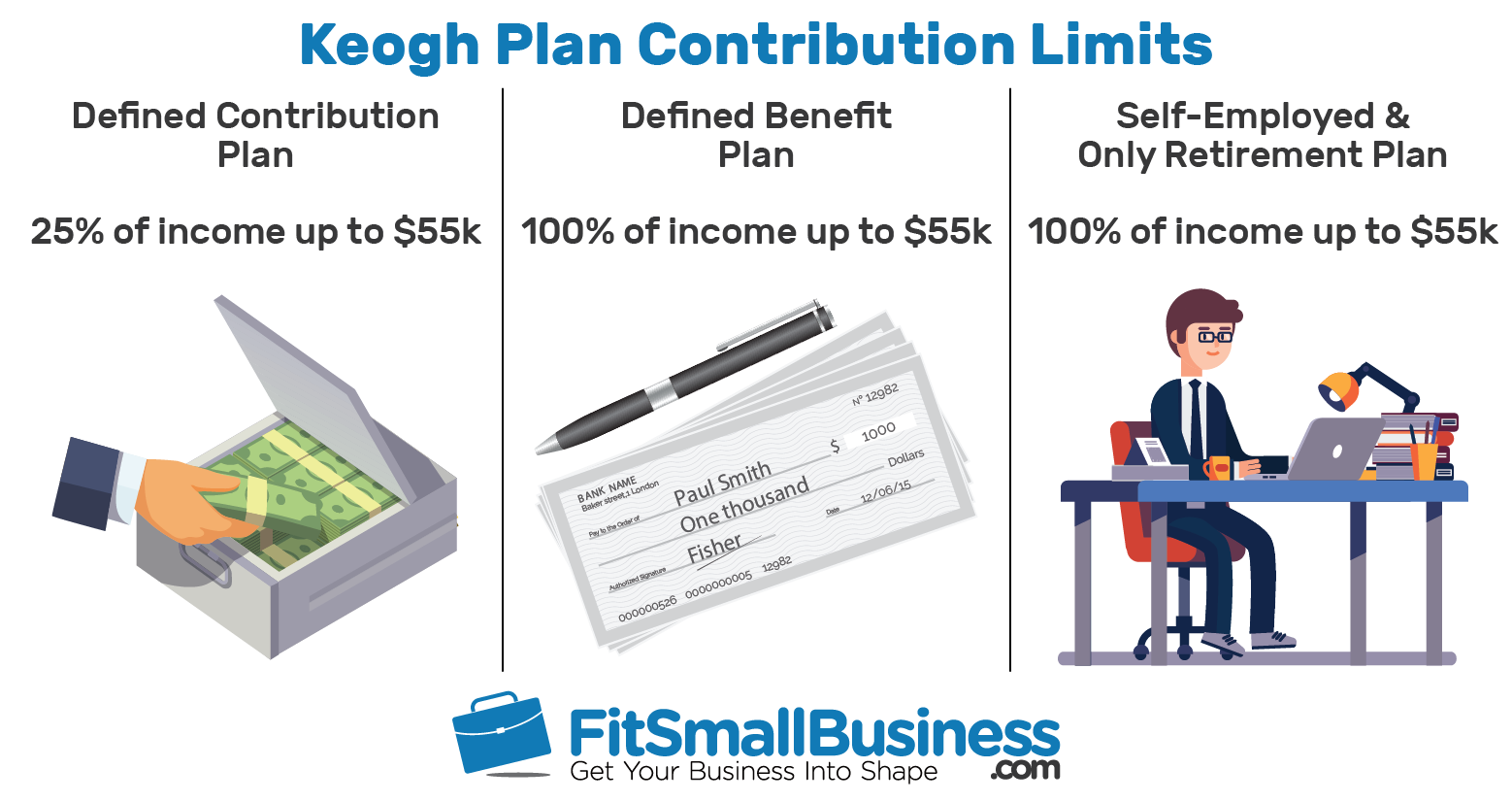

keogh plan contribution limits Choosing Your Gold IRA, Even though you can contribute up to $6,000 annually, it might not suffice to help you reach your savings goals. However, they’ve declined in popularity, with individual/single 401 (k)s and sep iras climbing to the top of the list of retirement.

Keogh Plan Contribution Limits, Rules & Deadlines, The keogh plan is a retirement plan created especially. Keogh plans are still used today;

401(k) Contribution Limits for 2025, 2025, and Prior Years, The irs has increased your overall. Keogh plans are still used today;

Keogh Plan Contribution Limits, Rules & Deadlines ROI Advisers, The irs has increased your overall. 2025 contribution limits for 2025, you can.

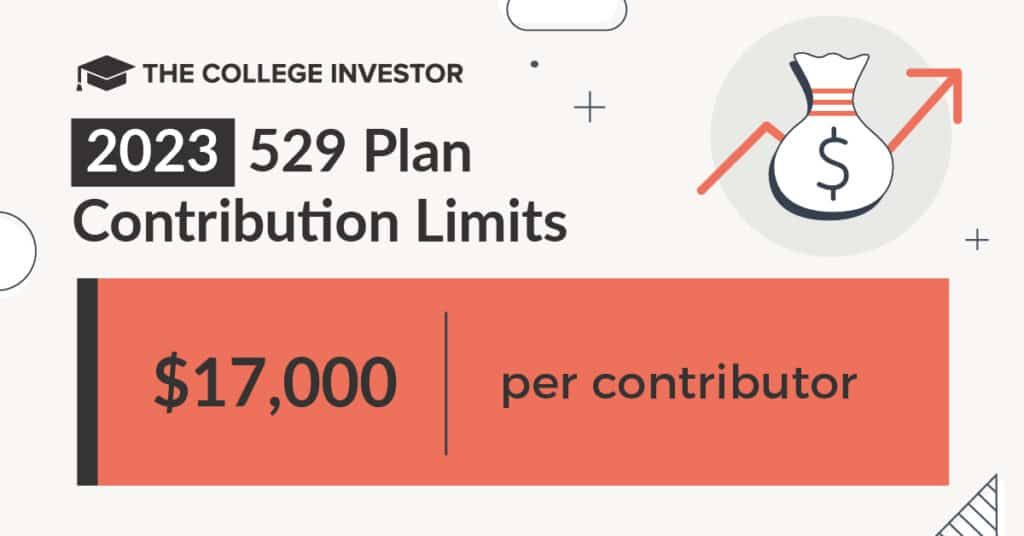

529 Plan Contribution Limits For 2025 And 2025, For 2025, the maximum contribution for sep accounts and most keogh plans is the lesser of 25% of net earnings or $61,000 (increasing to. The contribution limits for keogh plans in 2025 is the smaller of 25% of salary or $69,000.

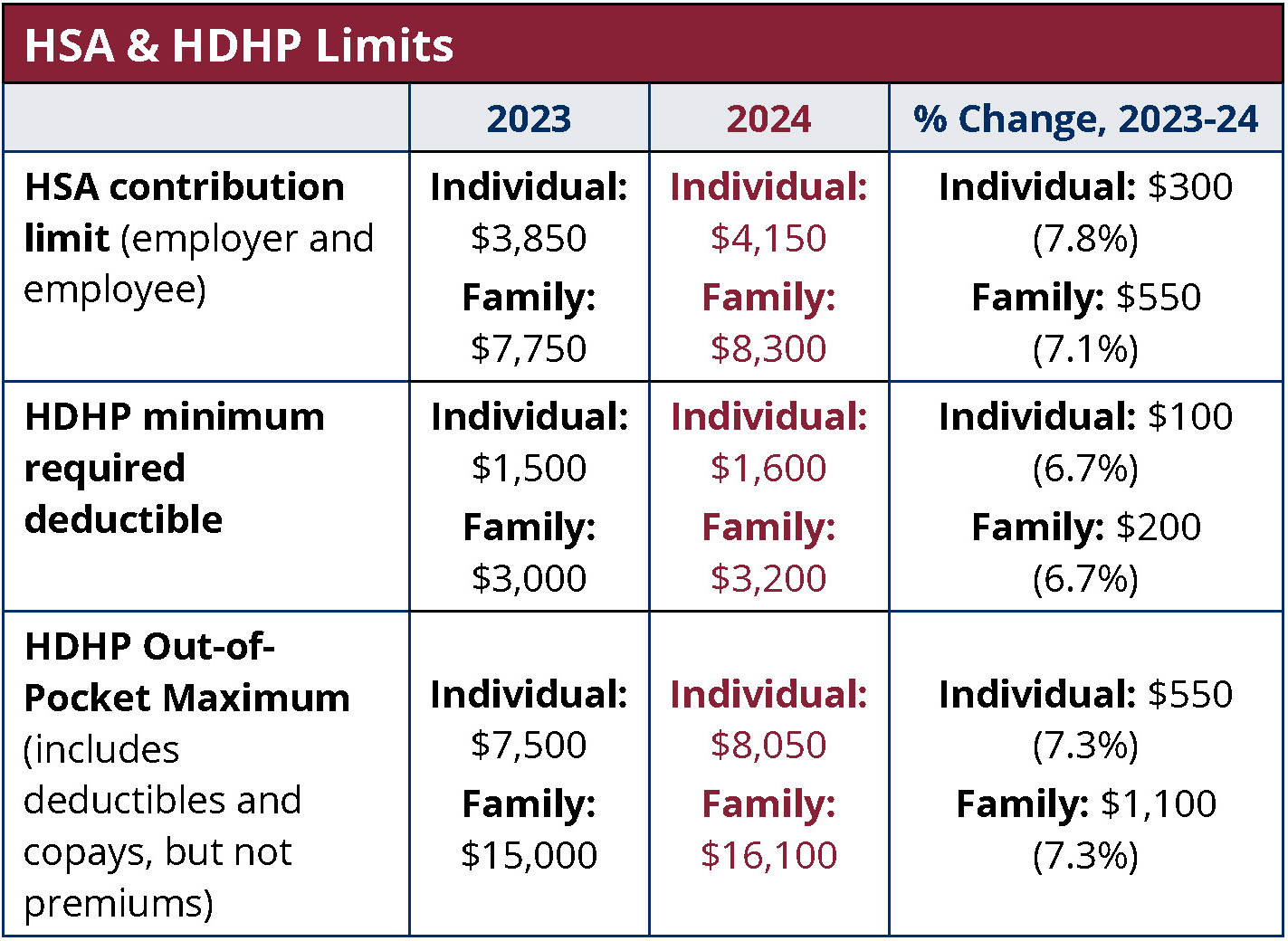

Significant HSA Contribution Limit Increase for 2025, 2025 contribution limits for 2025, you can. 401(k)s limit you to $22,500 in contributions in 2025 if you’re.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Contribution limits in the keogh plan are: A keogh plan is a retirement plan designed for self.

401(k) Contribution Limits in 2025 Meld Financial, The keogh plan is a retirement plan created especially. How does a keogh plan work?

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, 2025 contribution limits for 2025, you can. How does a keogh plan work?

2025 HSA Contribution Limits Claremont Insurance Services, 2025 contribution limits for 2025, you can. 401(k), 403(b) and eligible 457 plan elective deferrals (and designated roth contributions) $23,000: