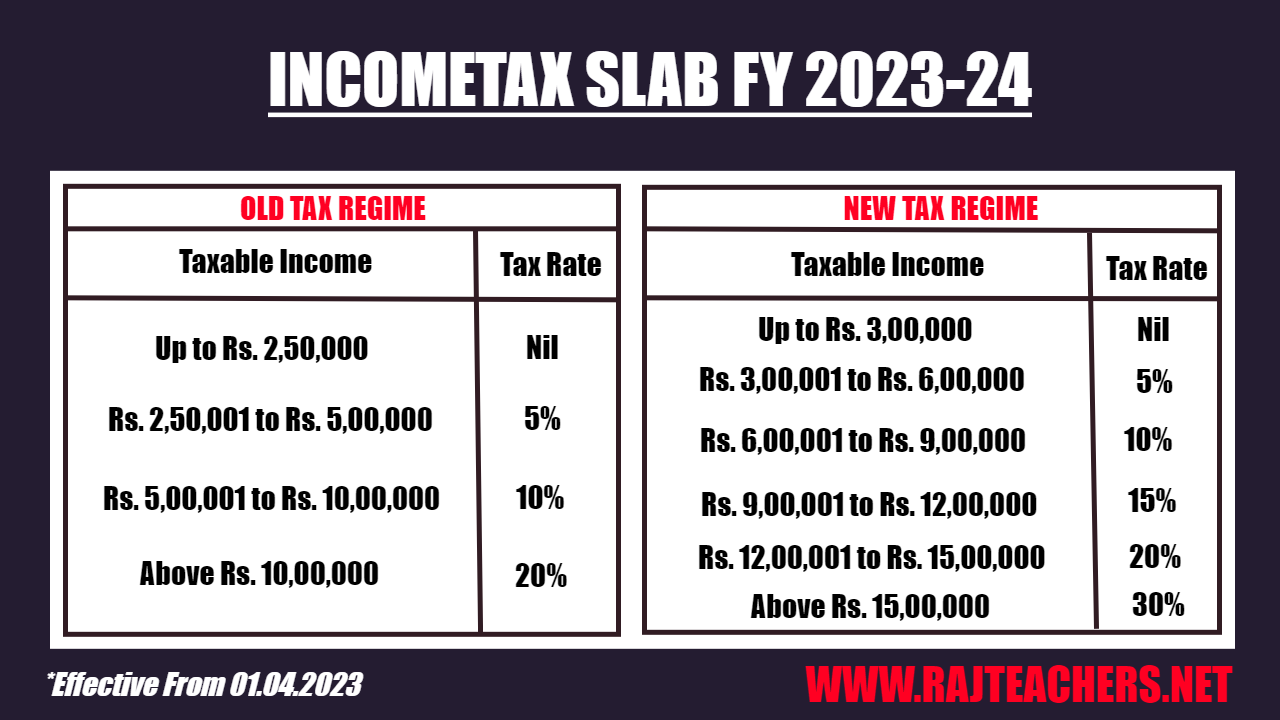

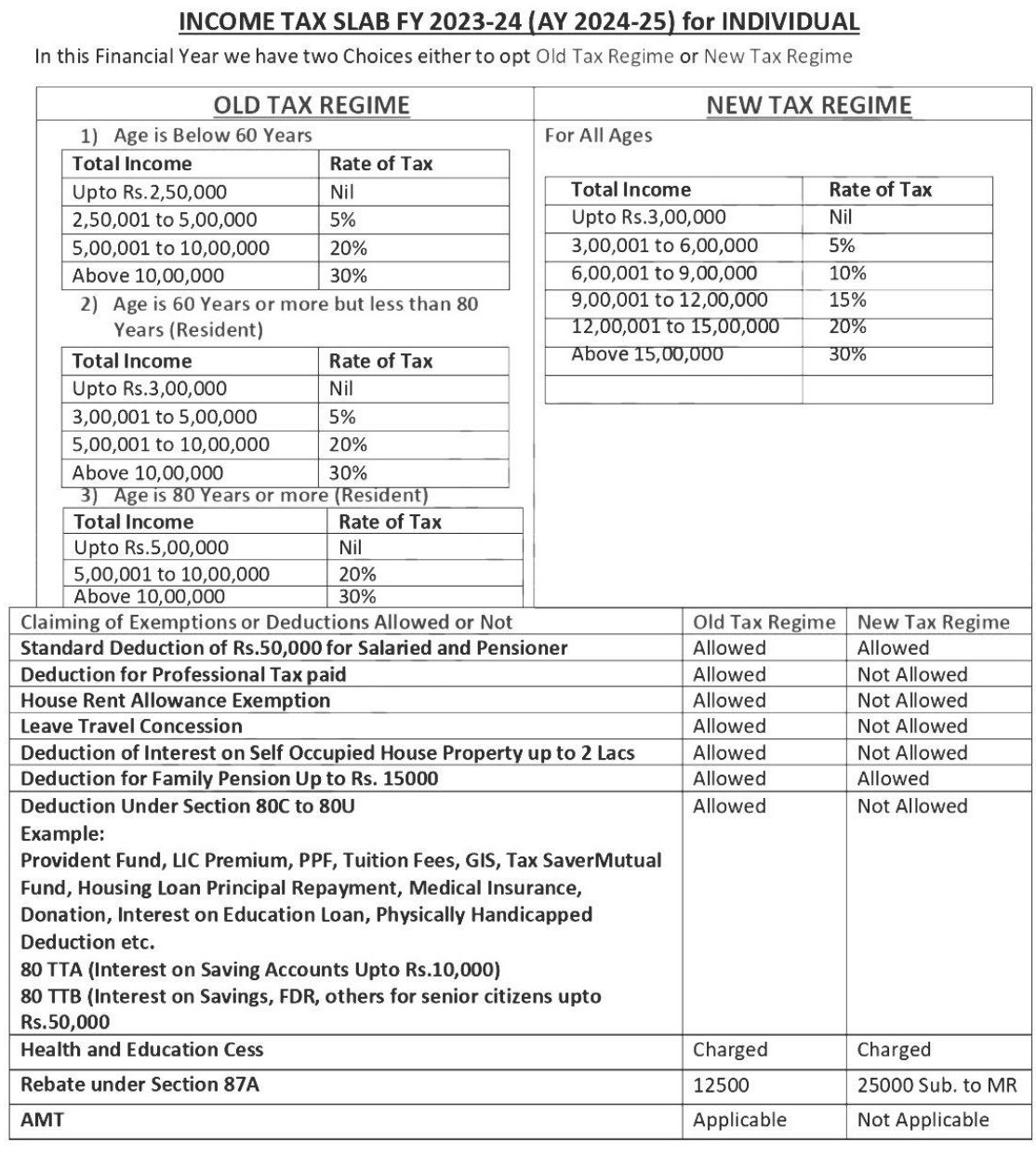

Income Tax Slab For Fy 2025-24. Click here to view relevant act & rule. Here's our latest guide on the new income tax slab for both old and new tax regimes for individuals below 60 years and senior citizens.

Information relates to the law prevailing in the year of publication/ as indicated. Calculation and slabs that existed before the introduction of the new tax regime.

Tax Slab For Ay 2025 24 For Salaried Person New Regime, Income tax slab determine the rate at which an individual/entity is taxed.

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Viewers are advised to ascertain the correct.

Tax Slab For Fy 202424 Ay 202425 Pdf Tabbi Faustina, Calculation and slabs that existed before the introduction of the new tax regime.

Tax Rates Slab for FY 202324 (AY 202425), Individuals, including senior and super senior citizens, are taxed according to a progressive slab system, with rates ranging from 5% to 30%, depending on their income.

Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog, Individuals, including senior and super senior citizens, are taxed according to a progressive slab system, with rates ranging from 5% to 30%, depending on their income.

TAX SLAB FY 202324 (AY 202425) for INDIVIDUAL, Calculation and slabs that existed before the introduction of the new tax regime.

Tax Slab 2025 24 Calculator PELAJARAN, Here's our latest guide on the new income tax slab for both old and new tax regimes for individuals below 60 years and senior citizens.

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp)

Tax Slab Rates FY 202425 Old vs New Tax Regime FinCalC Blog, Individuals, including senior and super senior citizens, are taxed according to a progressive slab system, with rates ranging from 5% to 30%, depending on their income.

Know About The Tax Slab Rates For FY 202324, Some key highlights of the above income tax slabs are: