Conforming Loan Limits 2025 Fhfa. The federal housing finance agency (fhfa) announced it will increase the 2025 conforming loan limits for mortgages acquired by fannie mae and. Detailed addendum of the methodology used to determine the conforming loan limits.

These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000. Fannie and freddie are both regulated by the federal housing finance agency (fhfa), which is why their loan products are so similar.

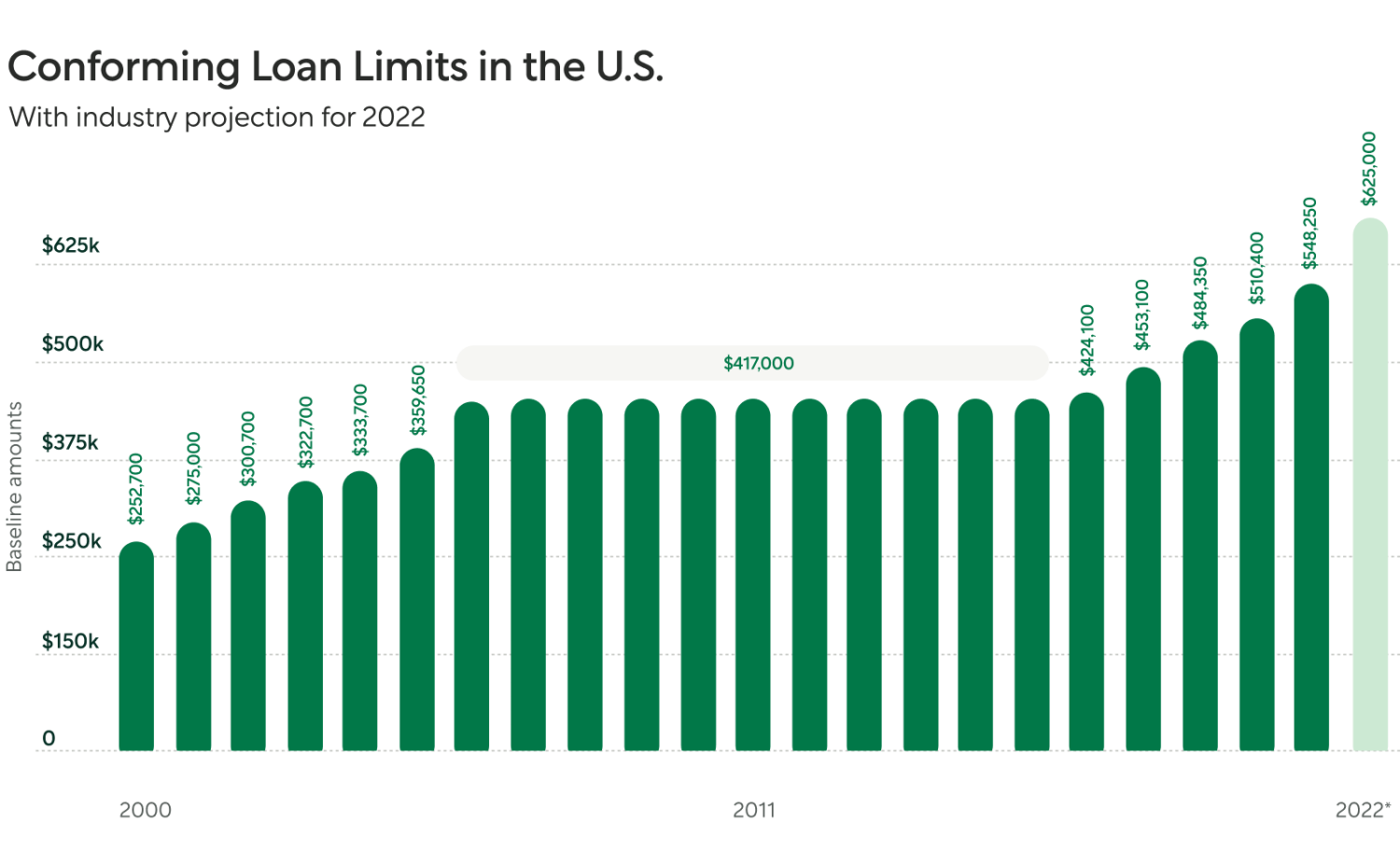

Fhfa conforming loan limits increase to $766,550 in 2025 conforming loan limits will increase at a slower pace next year, mirroring home prices november 28,.

For fha, the new conforming loan limit for 2025 is $498,257, marking a $60,000 increase over last year’s.

New Conforming Loan Limits Increase for 2025 Guaranteed Rate, For fha, the new conforming loan limit for 2025 is $498,257, marking a $60,000 increase over last year’s. Fhfa is the regulator of fannie mae and freddie mac.

FHFA Increases Conforming Loan Limits to 766,550 for 2025 BAM, Your buying power is increasing. These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000.

2025 Colorado Conforming Loan Limits FHFA Changes — Christopher Gibson, List of faqs that covers broader topics that may be related to cll values. Fannie and freddie are both regulated by the federal housing finance agency (fhfa), which is why their loan products are so similar.

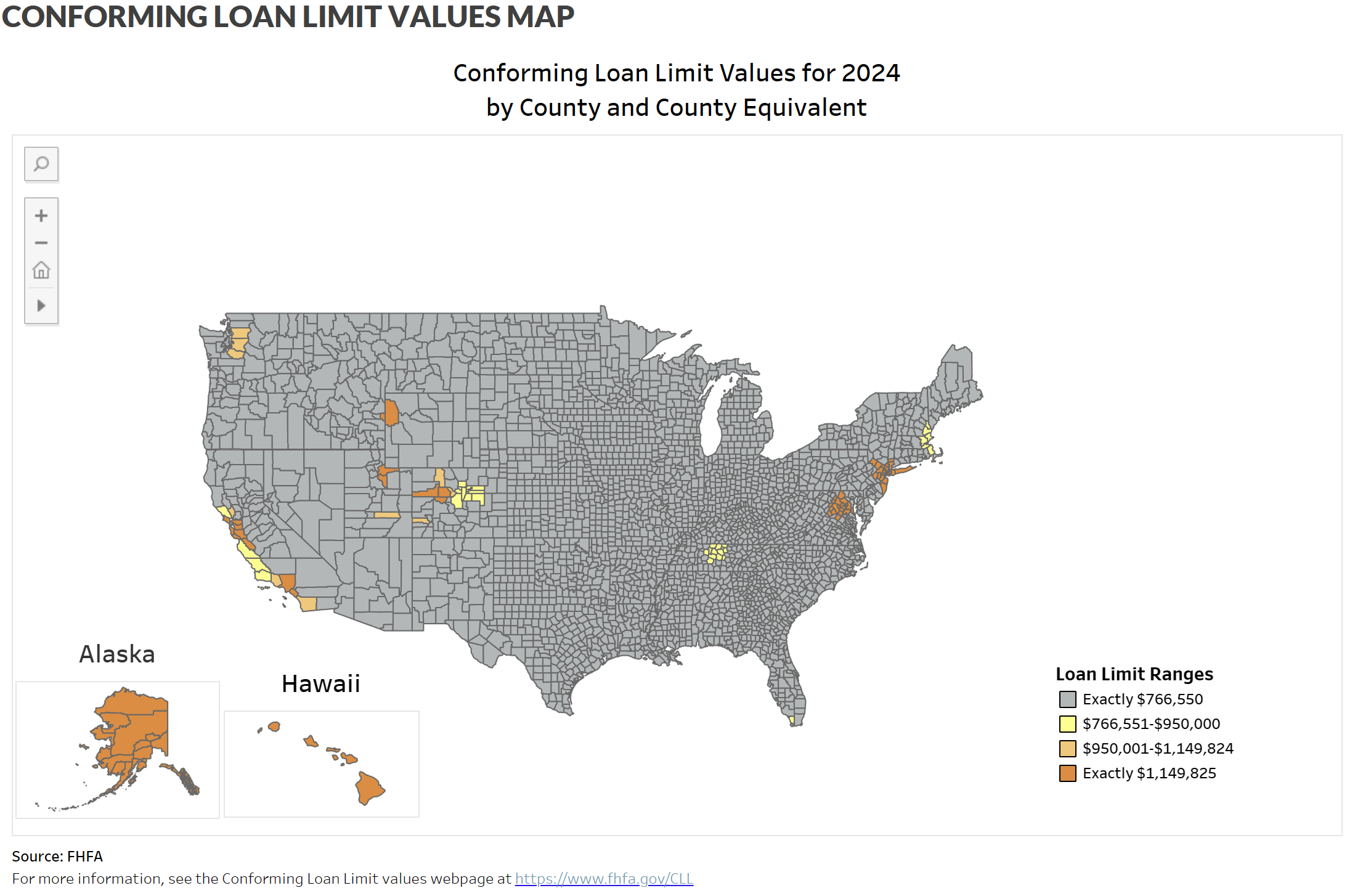

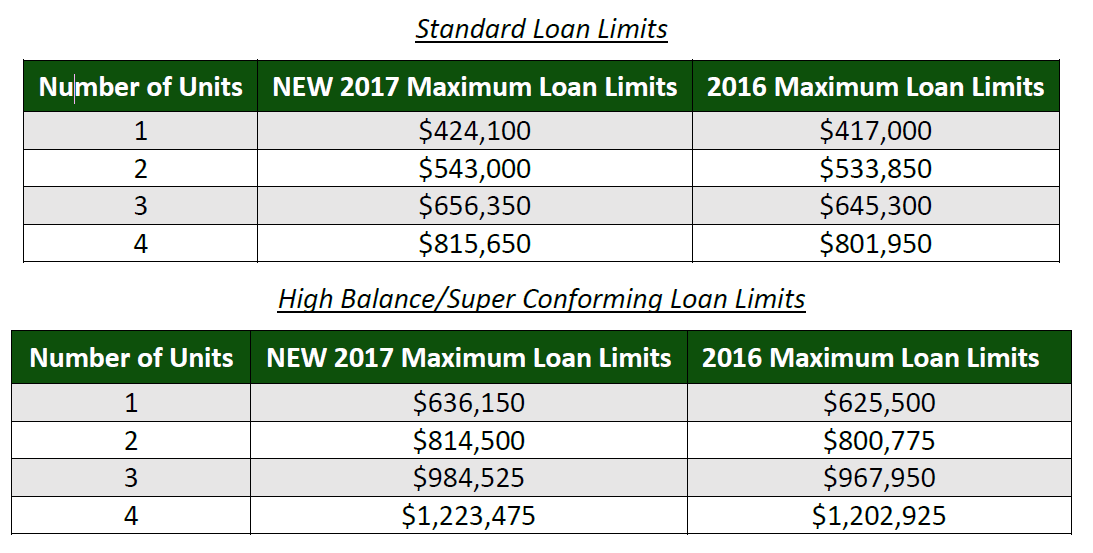

New FHFA Conforming Loan Limits for 2025 (conventional), Special statutory provisions establish different loan limits for alaska, hawaii,. These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000.

2025 New Conforming Loan Limits For Colorado, In most of the united states, the 2025 cll. These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000.

2025 Conforming Colorado Loan Limits, These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000. Fhfa is the regulator of fannie mae and freddie mac.

New Conforming Loan Limits Increase for 2025 Guaranteed Rate, Fannie and freddie are both regulated by the federal housing finance agency (fhfa), which is why their loan products are so similar. In these areas, the baseline loan limits will be.

The FHFA Increases Conforming Loan Limits for 2025, For fha, the new conforming loan limit for 2025 is $498,257, marking a $60,000 increase over last year’s. In these areas, the baseline loan limits will be.

Conforming Loan Limits Are Going Up Better Mortgage, Historical loan performance data pooltalk® treasury bridge™ Special statutory provisions establish different loan limits for alaska, hawaii, guam, and the u.s.

TWO POSITIVE CHANGES HIGHER CONFORMING LOAN LIMITS, LOWER FHA MORTGAGE, These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000. For fha, the new conforming loan limit for 2025 is $498,257, marking a $60,000 increase over last year’s.

These conforming loan limits are governed by the housing and economic recovery act of 2008 (hera), which established the baseline loan limit at $750,000.